Are you wondering how to download your TIN certificate using your NID number? You’re in the right place.

The process is actually simpler than you think. Whether you’re a new taxpayer or a seasoned business owner, downloading your TIN certificate is an essential step in handling your taxes in Bangladesh.

Let’s break it down, step-by-step.

What Is a TIN Certificate, and Why Do You Need It?

Let’s start with the basics.

TIN stands for Taxpayer Identification Number. It’s issued by the National Board of Revenue (NBR) in Bangladesh and is crucial for anyone involved in financial transactions, business dealings, or tax filings.

Without a TIN certificate, you won’t be able to:

- Register for VAT

- File your tax returns

- Pay taxes online

- Conduct many business operations smoothly

So, if you’re serious about getting your financials in order, having an ETIN certificate (Electronic TIN) is a must.

And here’s the good news: You can get it easily by using your NID number.

How to Activate ETIN Certificate Download by NID Number

Now, let’s get into the step-by-step process of activating and downloading your TIN certificate using your National Identity Card (NID).

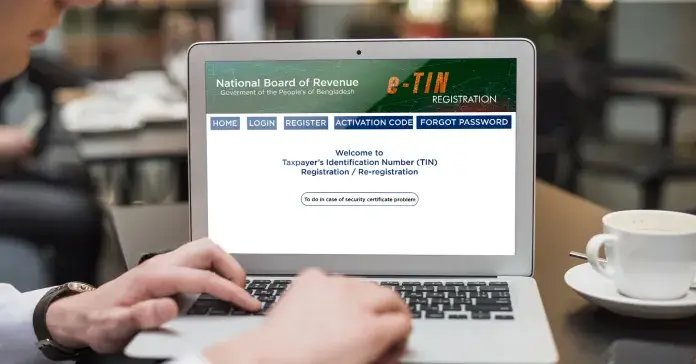

Step 1: Head to the NBR Website

First things first. Go to the official website of the National Board of Revenue (NBR).

There, you’ll find a section dedicated to e-TIN registration.

Step 2: Register for a New Account

If you don’t have an account yet, no problem. You’ll need to register by providing some basic details:

- Your NID number

- Your name

- Contact details (email and phone number)

This is a super important step, as your TIN will be linked to your NID.

Step 3: Verify Your Account

After entering your information, the system will send you a verification code via SMS or email.

Enter the code, and you’re all set for the next part.

Step 4: Login and Complete Your Profile

Once verified, log in to your account. Now, fill in additional details such as:

- Your taxpayer status (individual or business)

- Bank account details (if applicable)

- Any other relevant tax information

Step 5: Download the ETIN Certificate

Now comes the best part.

After filling out all the required info, go to the “Download e-TIN Certificate” section. Here, you can either download or print your ETIN certificate.

And that’s it. Easy, right?

How to Download the ETIN Certificate by NID Number

Once you’ve registered, downloading the ETIN certificate is a piece of cake.

Step 1: Go to the NBR Website

Navigate back to the NBR’s website.

Step 2: Find the e-TIN Certificate Section

On the homepage, select the option for “e-TIN Certificate.”

Step 3: Enter Your NID Number

You’ll need to enter your NID number to retrieve your information.

Step 4: Click Download

Once you’ve confirmed your identity, simply hit download, and you’ll have your TIN certificate ready to go.

How to Print Your ETIN Certificate

Now that you’ve got the certificate on your device, you may want to print it out for your records.

Step 1: Open the File

Locate the PDF file of your downloaded ETIN certificate.

Step 2: Print It Out

Once opened, hit Ctrl + P (or use the print option on your browser/PDF viewer), and choose your printer settings.

How to Log In to the TIN Portal

Already have your TIN and just need to log in? Here’s how to do it.

Step 1: Head to the NBR TIN Portal

Go to the TIN login page on the NBR website.

Step 2: Enter Your Credentials

You’ll need your:

- UserID (could be your NID number)

- Password (set during registration)

After logging in, you can access and update your taxpayer profile, download documents, or even file tax returns.

Potential Disadvantages of Using NID for ETIN

While linking your NID to your ETIN makes things seamless, there are some downsides you might want to consider.

- Non-Transferable

Since your TIN is tied to your NID, it’s unique to you. If you need to make changes or transfer information, it can get tricky.

- Security Concerns

If someone gains access to your NID, they might also access your tax records. Always keep your login details secure.

- Documentation Process

It can be time-consuming to get everything verified, especially if any of your NID details are incorrect or outdated.

FAQs: Your Quick TIN Certificate Questions Answered

Q: How do I get a TIN certificate using my NID? A: Simply visit the NBR website, register using your NID number, and download the TIN certificate.

Q: Do I need to pay for a TIN certificate? A: No, registering and downloading your TIN certificate is free on the NBR portal.

Q: What do I do if I forget my TIN login? A: You can reset your password through the NBR login page using your NID.

Q: Why is my NID linked to my TIN? A: Linking your NID ensures accuracy and connects your tax profile to your identity, which simplifies the process.

Q: Can I download my TIN certificate again if I lose it?A: Yes, just log in to your account on the NBR website, and you can download it anytime.

Conclusion

Getting your TIN certificate using your NID number is easier than ever, thanks to the NBR’s online portal.

The whole process—from registration to downloading—can be done in just a few steps.

But remember, security and accuracy are key. Make sure to keep your NID details and TIN login credentials safe.

If you’re still unsure, check the official NBR website for more detailed instructions, and you’ll be set in no time.

Your financial future just got a little bit smoother.

Leave a Reply